501c3 Non-Profit Status & Tax Deductible Contributions

Disclaimer: IRS laws change frequently and as such, IRS.gov should be the final reference on all tax-deductible questions. This should serve only as a general guide. If you have any additional questions, please do not hesitate to contact us or the IRS.

What donations are accepted?

We currently accept monetary donations, apparel donations, and relevant building materials. If you would like to make any donation other than a monetary one please contact us.

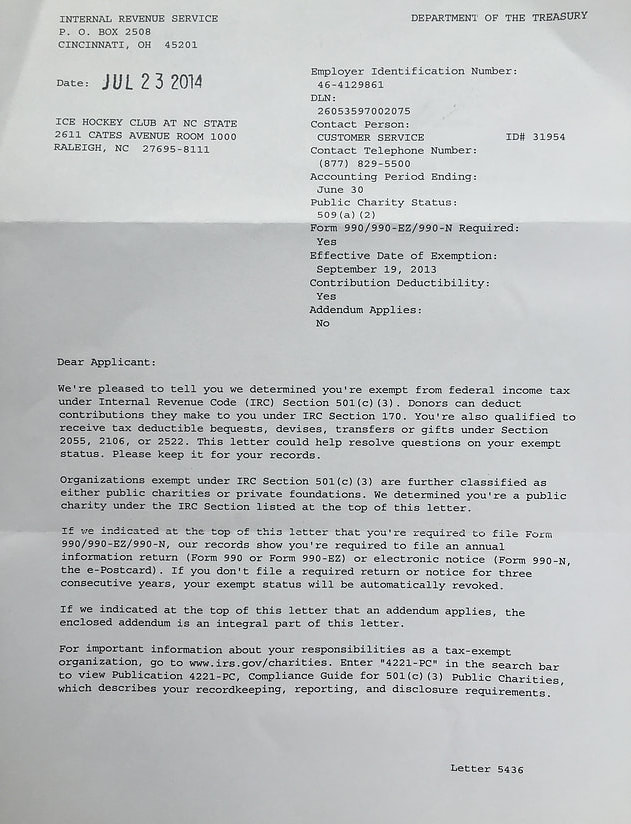

What is 501c3 non-profit status?Section 501(c)(3) is a part of the Internal Revenue Code (IRC) that determines the requirements for which an organization can be considered non-profit by the federal Internal Revenue Service (IRS). In order to maintain this status, organizations must prove that their operations are within the scope of 501(c)(3).

|

How does 501c3 status benefit you?Donations to our organization are tax-deductible. Donors may also have confidence that their contribution is going exclusivly to a non-profit cause. Since this status is back-dated to September 19, 2013, and contributions since that date are tax-deductible.

|

FAQ's

|

Q: Is the purchase of tickets or merchandise tax-deductible?

A: No. Since these an exchange of goods, they are not tax-deductible contributions. Only contributions that are not made in exchange for goods may be deducted from your taxes. If contributions are made in excess of received benefits, they may be tax-deducted. For example, if someone contributes $50 and they receive season tickets with an $18 value in return, $32 of their contribution is tax-deductible. |

Q: Are player dues tax-deductible?

A: No, similar to the situation regarding ticket purchases, these dues are in exchange for benefits and therefore can not be deducted from taxes. |

Q: Is volunteer time tax-deductible?

A: No, the value of time spent volunteering for a 501(c)3 organization is not tax-deductible

A: No, the value of time spent volunteering for a 501(c)3 organization is not tax-deductible